The image above is quite commonly seen in movies but have you wondered what does all those colors, graphs and numbers stands for? You would have questioned yourself but the movie was too good for us to pause and think. Well, this is generally known as Stock Market.

Before we start, let me make a short disclaimer. I am not an expert nor a professional in finance but rather an average joe who would love to share the knowledge I have gained so all of us could grow together. Therefore, every sentence here is based on my knowledge. So, please bare with me and let’s progress together.

Before we start, let me make a short disclaimer. I am not an expert nor a professional in finance but rather an average joe who would love to share the knowledge I have gained so all of us could grow together. Therefore, every sentence here is based on my knowledge. So, please bare with me and let’s progress together.

Stock Market, as you may have known is a place to buy and trade shares. But why is everyone so into stock market? Asking anybody who is financially stable always has one common answer, “I also invest in stocks”. Here I will be going over the basics and giving you some insides on how you can leverage the stock market to earn extra income.

What is Stock Market?

Stock market is a platform whereby activities to buy and sell the stocks issued by public-listed companies takes place. It’s basically an exchange platform for stocks. Companies need money from people. So by selling stocks, people will by them and become share holders of the company.

Let me give you an example. You opened a Restaurant XYZ in location A with a modal of RM50000. After running the restaurant for 1 year, you realized you are making good profit and planned to open another restaurant in location B which is in the center of the city. Now opening a new restaurant within 1 year profit is tough and with that location, you are required to have minimum modal of RM100000. You could either take loan from a bank or spend all your profit to open the restaurant. But there a catch, in case the restaurant doesn’t perform well, you might lose all you’re business.

Now there is another solution. You call up your friends, cliques or family members and seek them to provide some of the modal and than share the profit gained with them. When Friend 1 agrees to put in the cash, he become your partner. But Friend 1 can only put it RM20000. You still require RM80000. So Friend 2 and Friend 3 agrees to put in RM30000 each. With all that summed up, you only need to put in RM20000 to achieve your modal.

This is how stocks and companies work. Restaurant XYZ is the company, and you are the CEO. You acquire the modal from your shareholders which is this case are Friend 1,2 and 3. The profit from the restaurant is shared between all of you, its a win-win situation.

How can I use it to my advantage?

Now that I have explained to you what is stock market, the questions arises, how can I profit from this? Stock market is very volatile. Every minutes the prices of a stock changes. One minute the stock price could be as low as RM1 and the next minute it could be RM2 or maybe RM0.50. You can’t predict it. But that’s why the term High Risk High Return comes in . Stock Market is in the categorized as high risk investment.

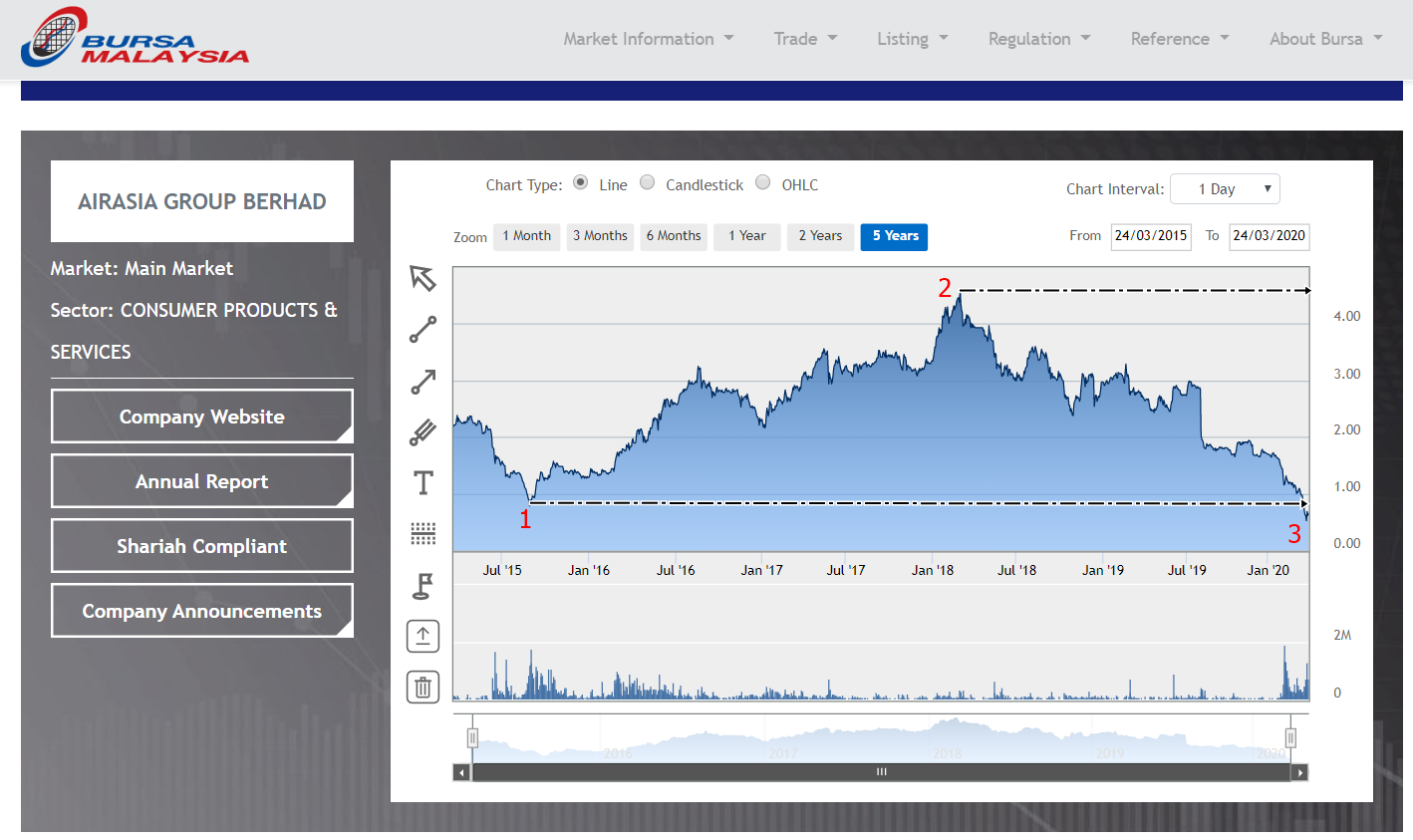

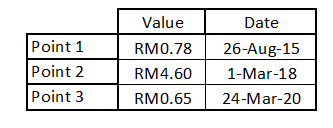

Are you getting a picture here? Stocks are bought cheap and sold when the price is high. Below is an example graph of Air Asia stocks as of 24th March 2020.  https://www.bursamalaysia.com/trade/trading_resources/listing_directory/company-profile?stock_code=5099 (The graph shows the trend for 5 years)

https://www.bursamalaysia.com/trade/trading_resources/listing_directory/company-profile?stock_code=5099 (The graph shows the trend for 5 years)

(In Bursa Malaysia you need to buy 100 stocks minimum so all the value stated above will be x100)

Lets assume you bought the stock at Point 1 for RM78 in 2015. Since you see that the curve is getting higher you just wait. After 3 years your realize the graph seem s to be at the peak and a stock price rises to RM460 in 2018. At this moment you decided to sell. A simple calculation will show you that you made RM382 in profit for 1 stock. Can you imagine that? If you did spend RM7800 in point one and sell it at Point 2 you would have made RM38200! Thats a big jump in profit. And this is only one of the stock. There are 100+ company stocks out there such as Telekom, Tenaga Nasional, Top Glove and many more. Now if you realized, as of 24th March 2020, the graph is down and one stock will only cost you RM65. So whats your move?

How do I start?‘

Investing is as easy as one, two, three!

Step 1 Open a Trading Account + CDS Account

This could be done in many of the local banks. The broker in the bank will assist you in opening your this account. You need to sign a few forms and produce two IC photocopies. You can check here https://www.imoney.my/share-trading to know the best place to open an account. As of now, Hong Leong has the lowest brokerage fee.

Step 2 Type of Account

Select the type of trading you want to do. There are a few options on the account type whereby the broker should explain to you before signing up. I would suggest you to go for the global trading account to ensure in the future you could start trading in oversea market and invest in Apple, Samsung or even Google!

Step 3 Trade!

Once you account is ready. Deposit some cash into your account and start trading. Remember make sure you do some research before investing.

Do I need to have a big modal to start trading?

No. Even RM100 is suffice for you to start. There are a lot of undervalued stocks which could cost you less than RM10 to become a shareholder.

Do I need to observe the market 24 hours?

No. The market will not instantaneously drop and lose all your cash. But instead keep update with business news and you will start predicting when will the market go up or down. Buy low sell high!

I bought a stock and now its dropping. What should I do?

Use dollar cost averaging method (https://www.investopedia.com/terms/d/dollarcostaveraging.asp). When the share price are dropping, there is your big chance to collect stocks. Focus on accumulating stocks and stay calm as the market will definitely bounce back.

Should I invest in stocks when market is high?

“Be fearful when others are greedy, and be greedy when others are fearful. —Warren Buffett”

The quote above means when the market is high, start scouting. Search for stocks that will drop in the near future. Read news, research companies and look at start predicting. Believe in your instinct. if you are still not sure, follow our stock market legends such as Mr Warren Buffett.

In conclusion, the best time to start investing is now. If you’re young and have no cash, borrow some from your parents, explain to them the situation and the possibility for you to start earning. Always remember the old proverb, “You will never know if you never try”. Most people don’t start investing because they are too afraid. Dare to be different and passionate on chasing your dreams. Many people have become a millionaire by trading stocks and now its your turn. Happy Investing.

Some website to assist you:-

You can find anything related to investing here. Its basically the Google for investors.

https://www.bursamalaysia.com/trade/trading_resources/listing_directory/main_market

Official website for Bursa Malaysia. You can find all the latest news, announcements, financial background of a company and many more through this website. The graphs here are 15 minutes late. So its not live.

https://www.khanacademy.org/economics-finance-domain

Here you find the basics of everything. This website is useful in case you want to study in detail how the economy works.